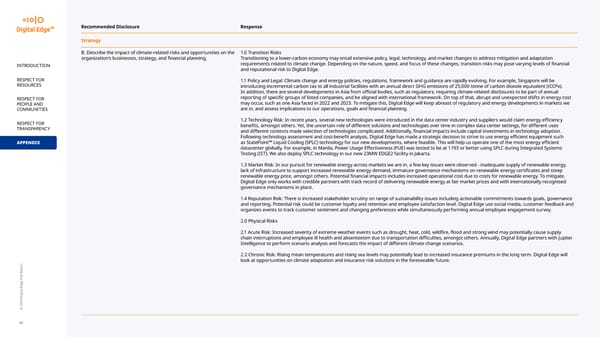

Recommended Disclosure Response Strategy B. Describe the impact of climate-related risks and opportunities on the 1.0 Transition Risks organization’s businesses, strategy, and 昀椀nancial planning. Transitioning to a lower-carbon economy may entail extensive policy, legal, technology, and market changes to address mitigation and adaptation requirements related to climate change. Depending on the nature, speed, and focus of these changes, transition risks may pose varying levels of 昀椀nancial INTRODUCTION and reputational risk to Digital Edge. RESPECT FOR 1.1 Policy and Legal: Climate change and energy policies, regulations, framework and guidance are rapidly evolving. For example, Singapore will be 2 RESOURCES introducing incremental carbon tax to all industrial facilities with an annual direct GHG emissions of 25,000 tonne of carbon dioxide equivalent (tCO e). In addition, there are several developments in Asia from o昀케cial bodies, such as regulators, requiring climate-related disclosures to be part of annual RESPECT FOR reporting of speci昀椀c groups of listed companies, and be aligned with international framework. On top of that, abrupt and unexpected shifts in energy cost may occur, such as one Asia faced in 2022 and 2023. To mitigate this, Digital Edge will keep abreast of regulatory and energy developments in markets we PEOPLE AND are in, and assess implications to our operations, goals and 昀椀nancial planning. COMMUNITIES RESPECT FOR 1.2 Technology Risk: In recent years, several new technologies were introduced in the data center industry and suppliers would claim energy e昀케ciency bene昀椀ts, amongst others. Yet, the uncertain role of di昀昀erent solutions and technologies over time in complex data center settings, for di昀昀erent uses TRANSPARENCY and di昀昀erent contexts made selection of technologies complicated. Additionally, 昀椀nancial impacts include capital investments in technology adoption. Following technology assessment and cost-bene昀椀t analysis, Digital Edge has made a strategic decision to strive to use energy e昀케cient equipment such APPENDIX as StatePoint™ Liquid Cooling (SPLC) technology for our new developments, where feasible. This will help us operate one of the most energy e昀케cient datacenter globally. For example, in Manila, Power Usage E昀昀ectiveness (PUE) was tested to be at 1.193 or better using SPLC during Integrated Systems Testing (IST). We also deploy SPLC technology in our new 23MW EDGE2 facility in Jakarta. 1.3 Market Risk: In our pursuit for renewable energy across markets we are in, a few key issues were observed - inadequate supply of renewable energy, lack of infrastructure to support increased renewable energy demand, immature governance mechanisms on renewable energy certi昀椀cates and steep renewable energy price, amongst others. Potential 昀椀nancial impacts includes increased operational cost due to costs for renewable energy. To mitigate, Digital Edge only works with credible partners with track record of delivering renewable energy at fair market prices and with internationally recognised governance mechanisms in place. 1.4 Reputation Risk: There is increased stakeholder scrutiny on range of sustainability issues including actionable commitments towards goals, governance and reporting. Potential risk could be customer loyalty and retention and employee satisfaction level. Digital Edge use social media, customer feedback and organizes events to track customer sentiment and changing preferences while simultaneously performing annual employee engagement survey. 2.0 Physical Risks 2.1 Acute Risk: Increased severity of extreme weather events such as drought, heat, cold, wild昀椀re, 昀氀ood and strong wind may potentially cause supply chain interruptions and employee ill health and absenteeism due to transportation di昀케culties, amongst others. Annually, Digital Edge partners with Jupiter Intelligence to perform scenario analysis and forecasts the impact of di昀昀erent climate change scenarios. 2.2 Chronic Risk: Rising mean temperatures and rising sea levels may potentially lead to increased insurance premiums in the long term. Digital Edge will look at opportunities on climate adaptation and insurance risk solutions in the foreseeable future. © 2024 Digital Edge ESG Report 40

2024 | Digital Edge ESG Report Page 39 Page 41

2024 | Digital Edge ESG Report Page 39 Page 41